QualiTau: Navigating Growth and Opportunities in the Chip Market

QualiTau is a top-tier provider in the semiconductor industry, revered for its outstanding performance in manufacturing and supplying reliability test equipment and services. The company's 2023 annual financial report has been published, and we cannot help but emphasize the tremendous potential we foresee for the upcoming year. In this article, we will explore the various avenues that QualiTau can leverage to assert its dominance in the industry.

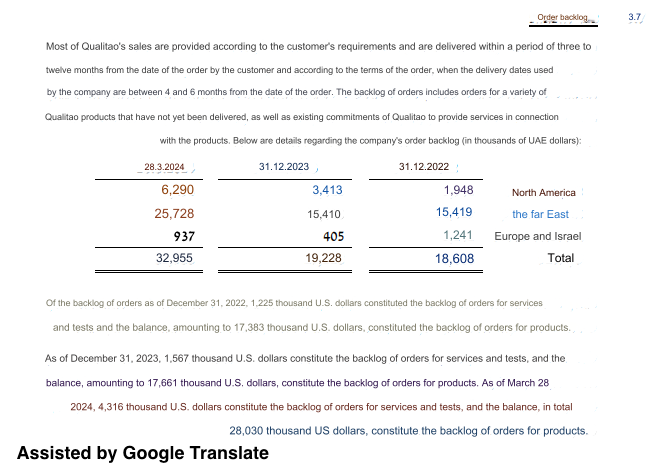

- The impressive order backlog testifies to the company's demand and qualities.

- Growth avenues, including the growth in the backlog in North America.

- Dividend distribution of approximately NIS 14.7 million (3.38 NIS per share).

In an economic cycle where inventory is fully available, customers tend to manage their orders over shorter time frames, unlike the past two years. Even though, Qualitau has increased its backlog and shows growth in North America.

Below is the order backlog announced by the company in the annual report (English by Google Translate):

In the expanding chip market, mergers or acquisitions with companies with complementary technologies or markets are possible. As far as I understand, the company's board desires this. The company has relatively convenient trading volumes for its market capitalization and relatively large public holdings. As the market capitalization grows, the liquidity increases through higher average trading volume, enabling funds of all sizes to participate.

With the entry of new American customers, there is significant potential to reduce dependence on the Chinese market. The next two years will be interesting, as the challenge is maintaining order backlog levels, expanding the customer base by reducing reliance on the Chinese market, and focusing on the M&A aspect.

The company's recently announced buyback program clearly manifests its financial strength and trust in its business.

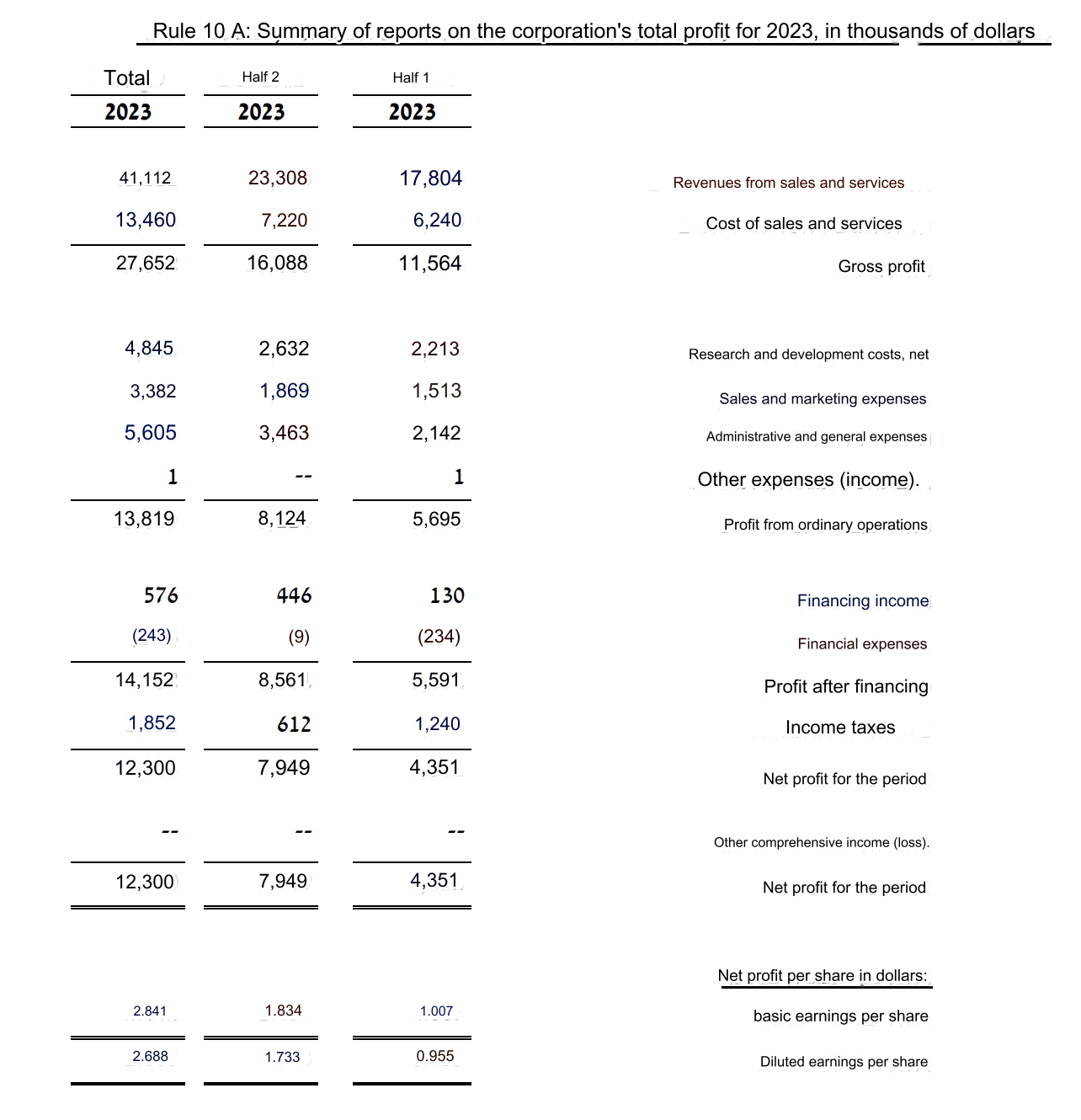

The current trading value of the company is approximately NIS 410 million dollars (around USD 110 million dollars). As of the beginning of the year, the order backlog stands at USD 33 million. In 2023, the company achieved a profit margin of almost 30% on its revenue, which indicates a potential net income of around USD 9.9 million based on the current order backlog.

Given the growth in the order backlog, we can anticipate a strong year for the company. This growth could lead to an increase in the company's valuation.

Below is the income statement announced by the company in the annual report (English by Google Translate):

Holding. Not a recommendation. $QLTU.TA

QualiTau - Annual Report for 2023

— EpsilonTal (@epsilontal) April 2, 2024

- The impressive order backlog testifies to the company's demand and qualities.

- Growth avenues, including the growth in the backlog in North America.

- Dividend distribution of approximately NIS 14.7 million.

In an economic cycle where… https://t.co/G3EchJRSeJ pic.twitter.com/bY7K8cilVH