Palram's Solid Financials and Growth Prospects: Insights from the 2023 Annual Report

Resilience and Growth: Palram's Journey Through 2023

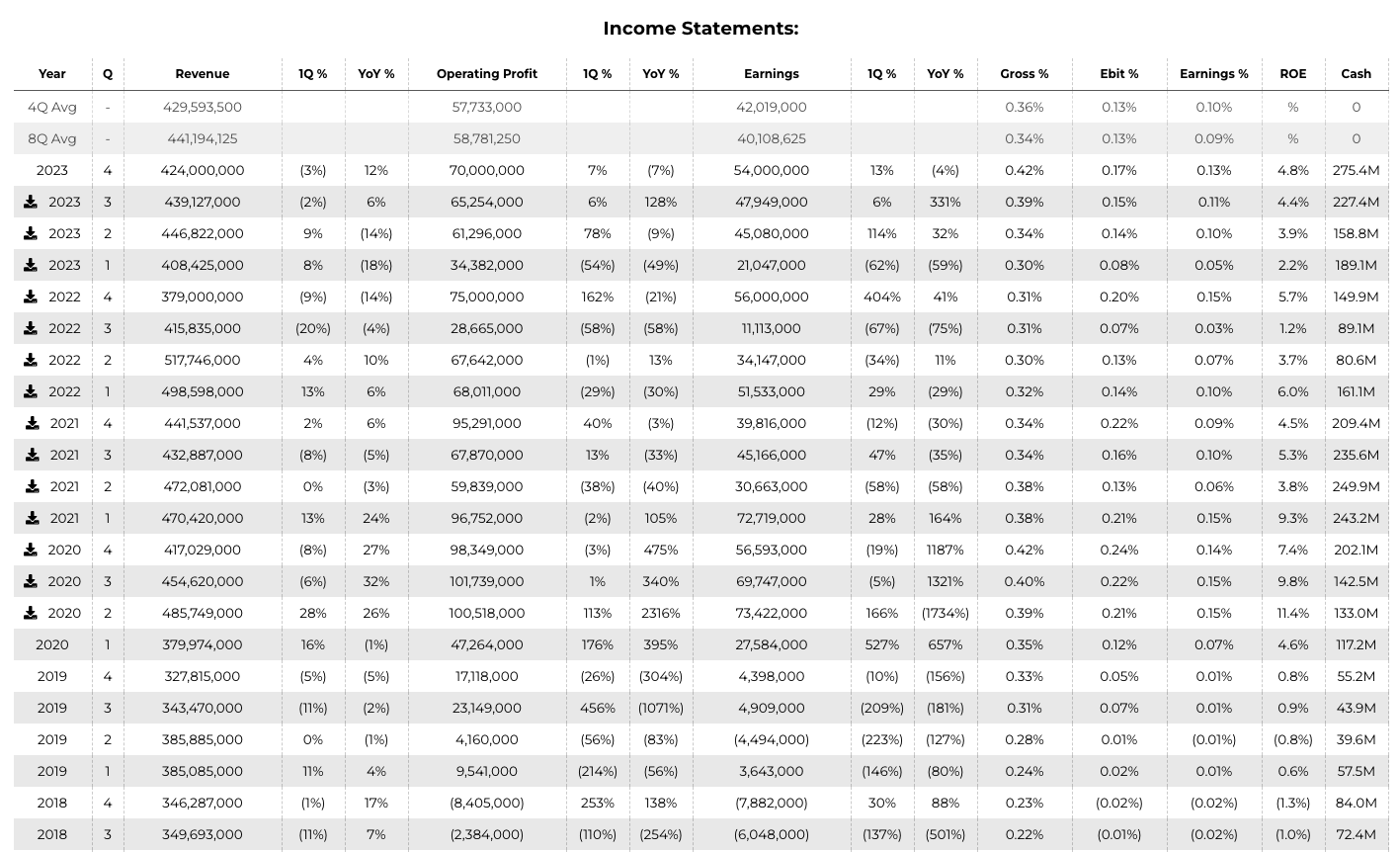

In the midst of economic fluctuations and operational challenges, Palram Industries has emerged as a resilient organization, primed for strategic growth. An in-depth analysis of Palram's 2023 annual report reveals the global leader in polycarbonate and PVC products has expertly managed its resources to strengthen its financial base, overcome significant obstacles, and seize new opportunities for expansion. The organization's strategic decisions in 2023, including the closure of unprofitable subsidiaries and the pursuit of ambitious acquisitions, provide a blueprint for thriving in the face of adversity.

Solid Foundations: A Look at Palram’s Financial Performance in 2023

A comprehensive analysis of Palram's financial performance, challenges overcome, and strategic expansion plans, including acquisitions and market share growth.

- 60 million NIS dividend.

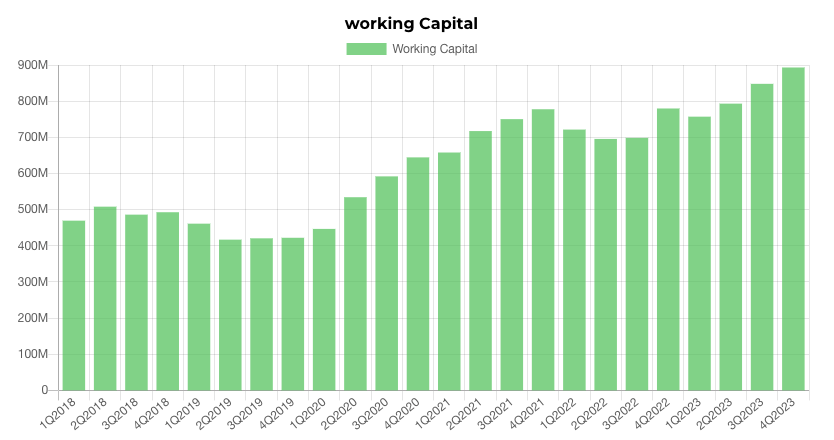

- 370 million NIS available in cash, cash equivalents (275m), and short-term investment (95m) for acquisitions and growth opportunities (minus the dividend).

Navigating Through Storms: Operational Challenges and Strategic Responses

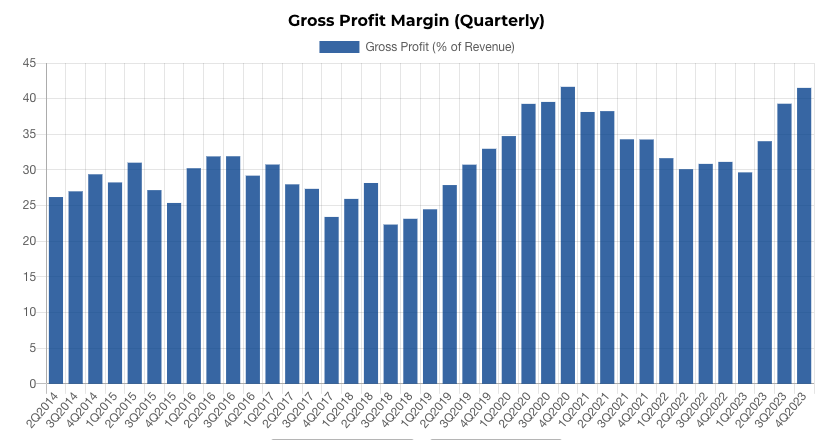

- The company's profit margins have improved significantly after closing unprofitable subsidiaries in the United States and Germany.

- Palram4U market extension "Tizug-Padgo" deal approved by Competition Authority.

Strategic Closures and Acquisitions: Strengthening Palram’s Market Position

Expand operations and get closer to end customers by acquiring laboratories and distributors in England and India.

Palram is in a solid financial position amidst this challenging period. The company has accrued hundreds of millions of NIS over the past four years and has distributed dividends to its investors by focusing on profitable business segments.

Impact of Global Events on Palram's Operations

The company had to overcome several challenges, including a shipping crisis that made it difficult to maintain a good profit margin and impacted its operations. Additionally, the war in Russia affected the projects of the company's subsidiaries, and an inflationary period led to an increase in raw material costs. Despite these obstacles, the company successfully navigated them.

Looking Ahead: Expansion and Innovation in Palram’s Horizon

After conducting an analysis, Palram is planning to expand its operational scope. This strategic expansion will involve acquiring companies in related sectors, investing more in research and development for new products, strengthening partnerships with current distributors and suppliers, and exploring new geographical markets and business areas.

Strategic Moves: What’s Next for Palram?

According to the analysis, the company is expected to see an increase in its market share. This anticipated growth stems from the higher costs of competing products and the company's ability to adapt its offerings, making them increasingly appealing to customers. Furthermore, the company's strategy to expand its market presence includes acquiring additional businesses.

Further Insights and Detailed Analysis: Visit Our Website

Explore the website for additional information. Please note that the data has been collected manually and may not be accurate. This information should not be considered as an official financial statement from the company. Holding, not a recommendation. Do your own research.

Palram - Annual Report for 2023

— EpsilonTal (@epsilontal) April 2, 2024

- 60 million NIS dividend.

- 370 million NIS available in cash, cash equivalents (275m), and short-term investment (95m) for acquisitions and growth opportunities (minus the dividend).

- The company's profit margins have improved significantly… https://t.co/v9ZJj9rLe1 pic.twitter.com/ttwgM2tfpD