Next Vision - Q2 2024 Financial Highlights

Intro

Next Vision was established in April 2009 as a private limited company in Israel and began its business operations in September 2009. The company develops, manufactures, and markets stabilized day and night cameras for ground and aerial platforms such as drones and micro-mini UAVs. The company also develops complementary products that reduce the integration time of the cameras into various customer platforms.

Conference Call

Introduction: During Next Vision's conference call summarizing the first half of 2024, Chairman Chen Golan, CEO Michael Grossman, and CFO Alex Lavie discussed a variety of important topics related to the company's performance, growth strategies, and challenges in the market. Below is a summary of the key points discussed, with an emphasis on important insights for investors.

Maintaining Transparency and Disclosure to Investors: Next Vision emphasizes the importance of transparency and disclosure to investors, especially in light of the company's rapid growth. During the call, the management clarified its intention to continue operating with transparency, including the possibility of sales segmentation by model in upcoming reports, with a special emphasis on the cooled cameras that have significant growth potential.

Order Backlog: The current order backlog showed a decline compared to the previous quarter, but the company noted that this is a seasonal trend due to reduced activity during the summer months. The company expects demand to return in the coming quarters, with no signs of problems in the overall backlog, and anticipates continued growth in sales, particularly in the North American market.

Cooled Cameras as a Key Growth Driver: Cooled cameras represent one of the company's main growth drivers. The company is investing time and resources in developing high-quality products and is taking into account the necessary development phases to bring flawless products to market. These cameras have now moved from the development stage to systematic production, and the company is capable of receiving orders and producing high-quality products.

Continued Global Growth: The company continues to see strong demand in Europe, which is currently in a state of war, and expects the current situation to last at least 3-5 more years. Even after the war subsides, the company believes that a rearmament trend will begin, maintaining the growth rate and expansion in the European market and other markets.

Growing Cash Reserves and Investments: Next Vision is benefiting from a growing cash reserve, which gives it greater flexibility in procurement and the ability to make non-organic investments. The company is exploring market opportunities and is looking to acquire companies or products with high synergy potential.

Progress in the American Market: The American market continues to be a central growth target for Next Vision. The company is working hard to boost marketing and prepare for large-scale production in this market. Company executives noted that they are in advanced stages with several companies in the American market and expect positive results to follow.

Preparation for Continued Growth: Next Vision is preparing for continued growth and increased demand, with high production capacity and the ability to maintain and increase it. The company is focused on maintaining high production rates and short delivery times to provide quick responses to its customers.

Competition: Next Vision faces ongoing competition from new products in the market. For example, the AVT camera presented in the conference poses competition, but the company maintains a competitive advantage thanks to the low weight of its products, which is an important factor in comparison to other products in the market.

Summary

The impression from the call is positive, and the company continues to aim high. It focuses on growth, recruiting quality personnel, expanding production capacity, and penetrating new markets, with a special emphasis on the American market. Next Vision presents a clear and focused strategy that promises stable growth and continued establishment as a leader in the global market.

Second Half Financial Results

Key Points and Conclusions

Ongoing Sales Growth: The company completed another quarter of strong sales growth, with significant growth in sales in North America, in line with the company's long-term work plan.

Expansion of Operations and Customers: The company continued to expand its operations with existing customers and entered into agreements with new customers, identifying high demand for its products and increasing production capacity to meet the demand.

Serial Production of Cooled Cameras: The new cooled camera entered serial production, and the company estimates that sales of this camera could reach significant levels.

Readiness for Continued Growth: The company's board of directors estimates that the company is well-prepared for continued growth thanks to its advanced development capabilities, wide range of products, and growing customer base.

Update on Growth Target: The company updated its annual growth target for 2024 to approximately 112% in sales volumes, replacing the previous target of approximately 70%.

Continued Global Growth: The company continues to market its products worldwide and is expanding its customer base, including new customers, due to global market growth trends.

Increase in Sales: During the reporting period, there was a 167% growth in sales compared to the same period last year. The total number of customers increased to 137 compared to 117 in the same period last year.

Order Backlog: As of the end of the reporting period, the company's order backlog stood at $79.1 million, providing a stable basis for continued growth in commercial activity.

Appendices

Balance Sheet

Working Capital

The company's working capital (the difference between current assets and current liabilities) in the first quarter of 2024 stood at approximately 78,308 thousand NIS. In the second quarter of 2024, the working capital increased to approximately 96,776 thousand NIS.

A rise in working capital can signal financial stability to investors and the company's ability to continue investing in growth, developing new products, and coping with market competition.

Current Assets

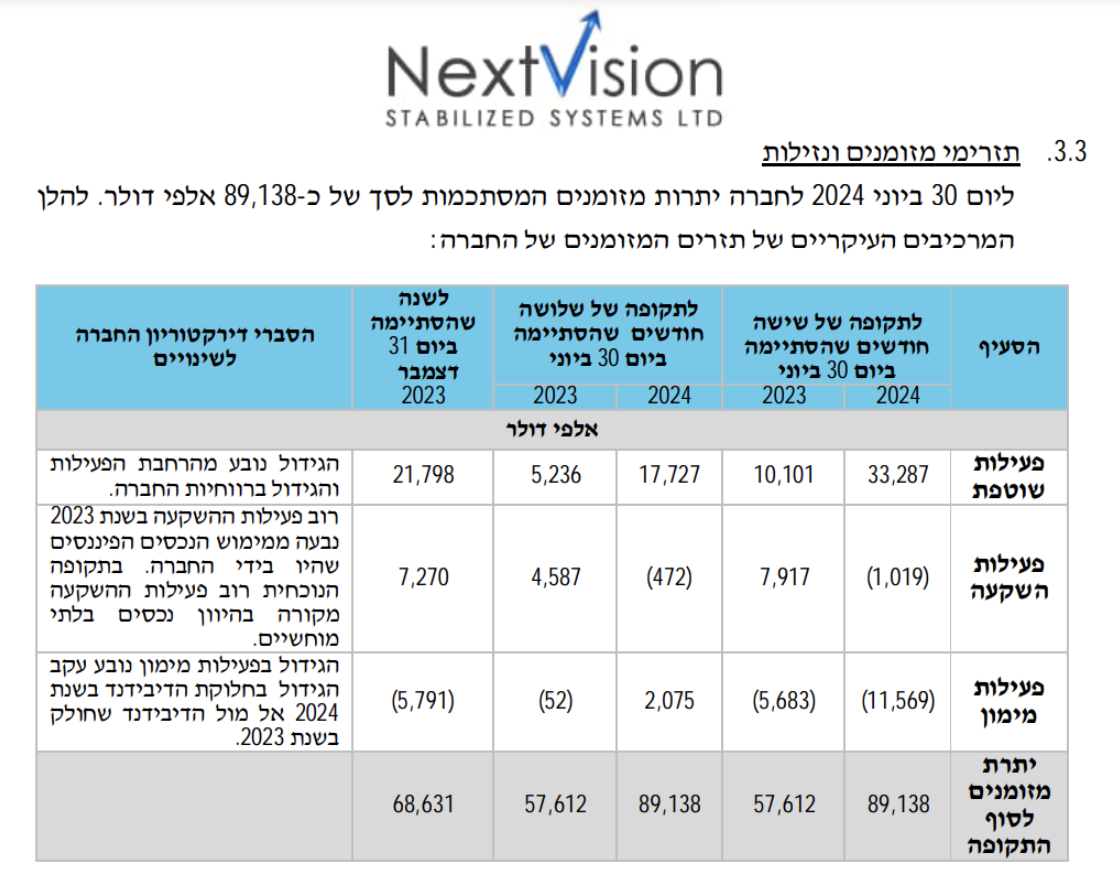

Significant Increase in Cash and Cash Equivalents: The company increased its cash reserves from $68.6 million in the first quarter to $89.1 million in the second quarter, indicating financial liquidity, high cash flow, and the ability to convert working capital into cash in a short time.

Increase in Inventory: The company's inventory grew significantly from $14.7 million in the first quarter ($15.9 million from the beginning of the year) to $16.8 million at the end of the second quarter, indicating an expansion in production activity and preparation for further demand growth.

Increase in Receivables and Customer Credit: The company experienced growth in sales volume, as reflected in the increase in receivables from $7.5 million at the beginning of the year to $8.5 million at the end of the second quarter, indicating an increase in commercial activity and expected growth in revenue in the near future.

Non-Current Assets

Investment in Intangible Assets: The company continued to invest in the development of new technologies and products, as reflected in the growth of intangible assets ("the increase is due to the capitalization of new developments of cameras and accessories during the period, offset by regular amortization.").

Increase in Assets Due to Rights of Use: The company's assets due to rights of use also increased, indicating an expansion of its operational activities ("the increase compared to the corresponding period last year is due to the lease of additional production areas to support the company's sales growth rate. Additionally, the extension of an existing lease option was realized. The decrease compared to December 2023 is due to regular amortization.").

The impressive growth in current and non-current assets in the second quarter of 2024 reflects Next Vision's ability to meet growing market demands and seize business opportunities that arise. The increase in cash and inventory provides the company with significant financial flexibility, while the ongoing investment in intangible assets and technology strengthens its competitive position in the market. These data indicate financial resilience and preparation for future growth, providing investors with confidence in the company's strategic direction.

Current Liabilities

Liabilities to Suppliers and Services: Remained similar to those of Q1 2024, but slightly decreased compared to the beginning of the year. The increase reflects the expansion of business activity, as the company purchases more materials and services for production and its operational expansion.

Profit or Loss

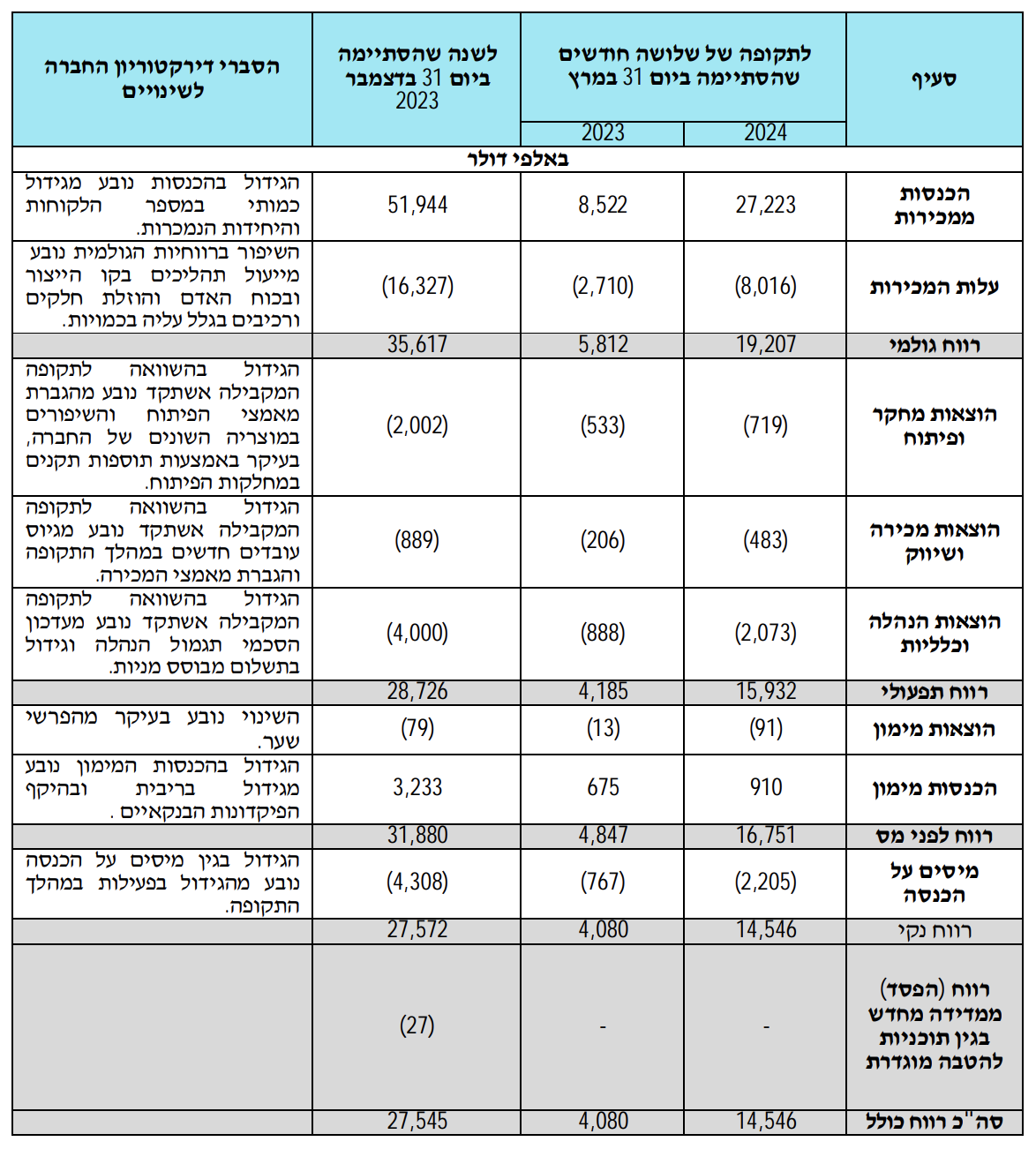

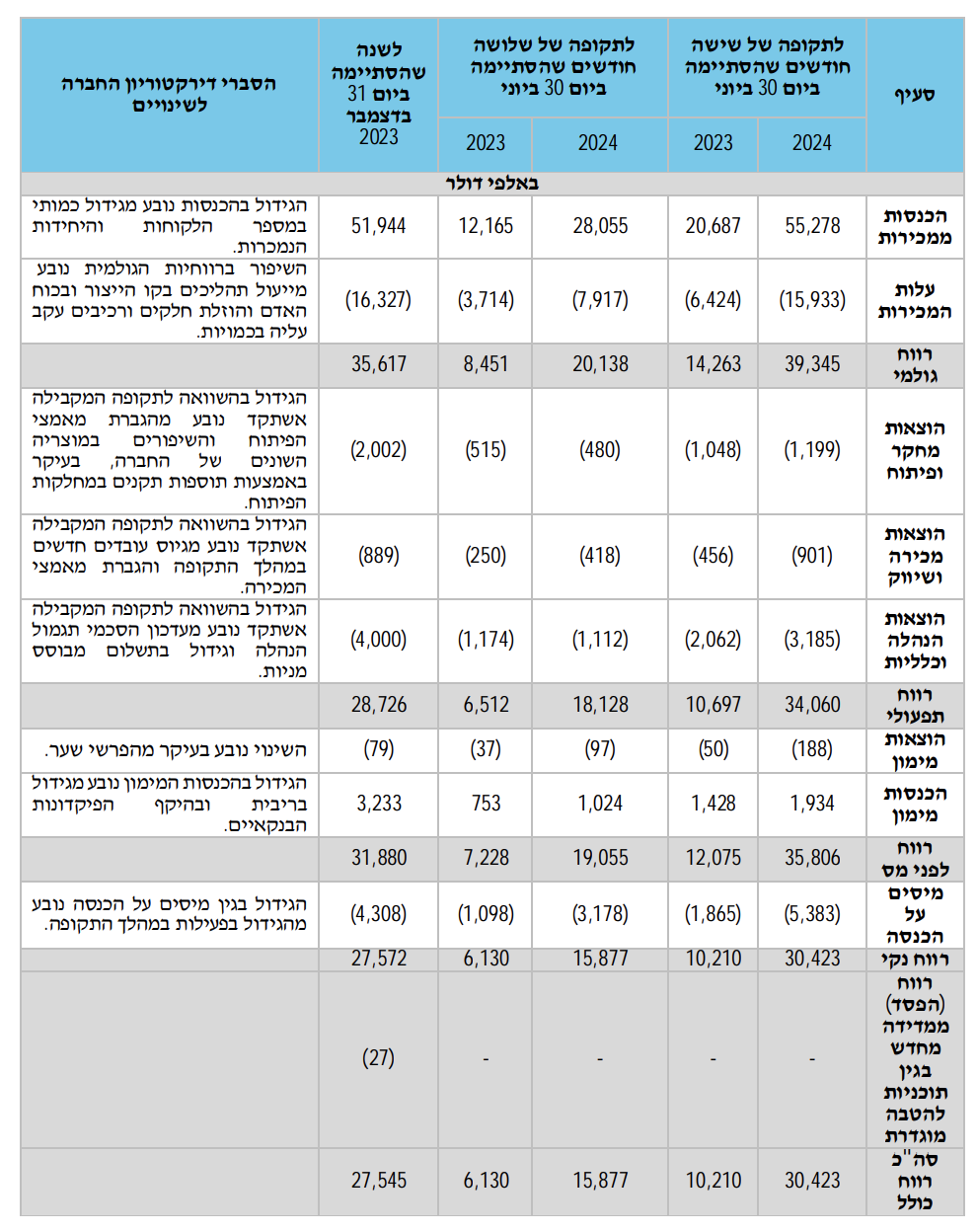

Here are the key points summarizing Next Vision's profitability in Q2 2024:

- Gross Profit: Gross margin of 71.78%, reflecting a high margin between production costs and sales prices.

- Operating Profit: Operating margin of 64.62%, indicating efficient management of operating expenses.

- Profit Before Tax: Profit margin before tax of 67.92%, reflecting the company's profitability before tax calculation.

- Net Profit: Net margin of 56.60%, after deducting all expenses and taxes.

These ratios show an improvement in profitability across all parameters compared to the previous quarter (Q1 2024).

Cash Flow

Since the beginning of the year, the company has shown cash flow of approximately $33 million from operating activities, offset by approximately $13.7 million due to dividend distribution for the profits of 2023.