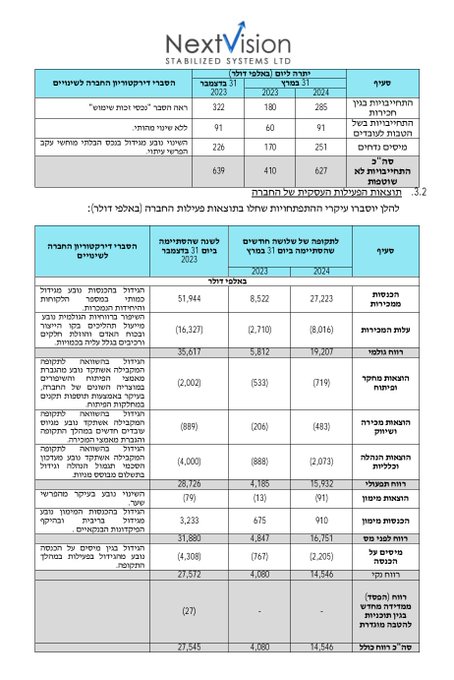

Next Vision - Q1 2024 Financial Highlights

The company develops stabilized drone imaging solutions and is experiencing increased product demand.

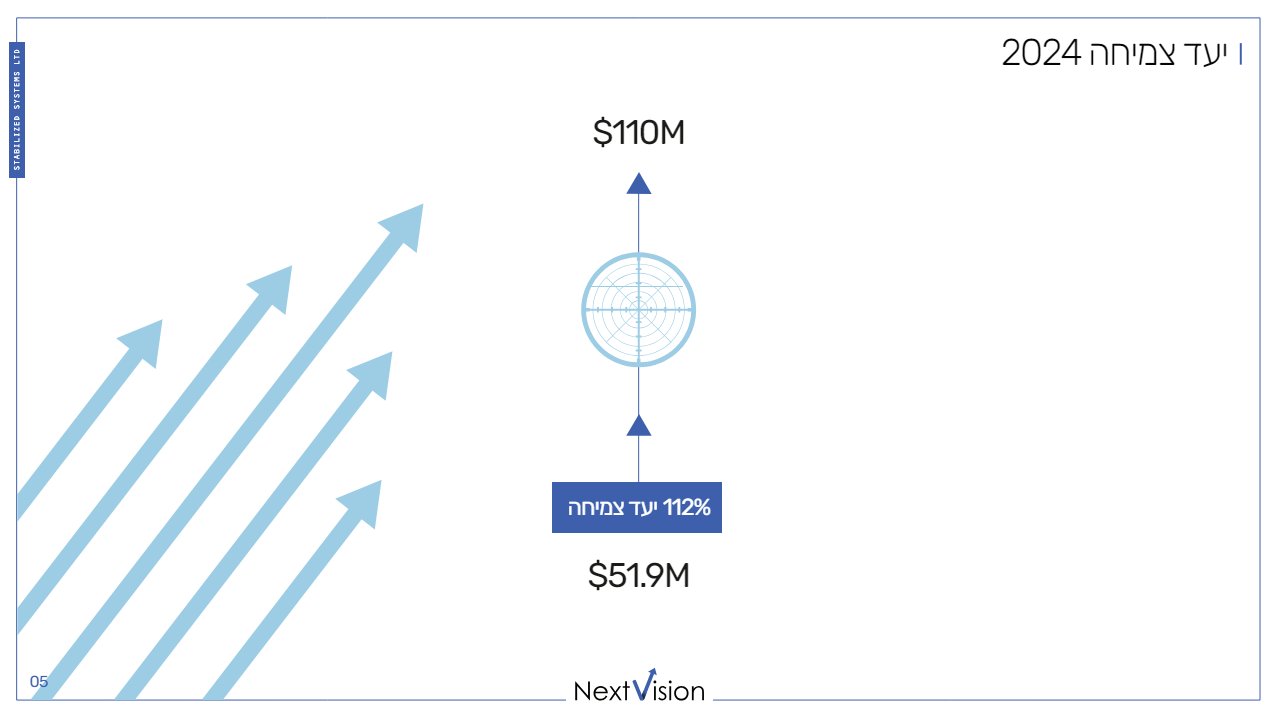

- Based on Q1 results, the company's growth target has been updated to 112%, reflecting revenues of $110M for 2024.

- Order backlog as of May 15, 2024: approximately $91M.

- Quarterly sales revenue: $27M.

- Quarterly net profit: $14.5M (53% of total sales).

Sales by Region

On March 13, 2024, I attended the company's conference and authored an article outlining my insights, including the potential in the American market (Link to Article).

One of the most critical sections in the 24Q1 financial statement is "sales by region." There, we can see a growth in sales in North America.

During 24Q1, the company sold $5.4 million worth of products in the American market, compared to $7.8 million for the entire year of 2023.

Also, we see growth in sales in "Other Countries."

The growth in sales in new regions during Q1 demonstrates the company's expansion into new markets, creating additional opportunities for sales growth.

Future PE & Valuation

Based on the current order backlog and the company's projected growth, the company is trading at a future PE ratio of around 22.

This is even though the company is experiencing sales growth in the "Other Countries" and "North America" regions and can increase the current order backlog further for the remainder of the year.

Next-Vision is considered a strong competitor in the market for the following reasons:

- Pricing: Despite high gross margins, the company's products are still considered "affordable" compared to the alternatives (=> there is room for price increment).

- Technological advantages: Next-Vision's cameras are lightweight, which allows drone manufacturers to build their products around Next-Vision cameras.

- It is difficult for customers to switch from Next-Vision's solutions to those of a competitor, as the product is considered "sticky".

Considering this, even if Next-Vision revenues do not grow in 2025 and only maintain the same level of order backlogs, we can still achieve affordable pricing for a company capable of generating over 50% net income margins.

Over time, the strong cash flow will enable the company to distribute dividends or acquire other technologies or companies.

Cooled Cameras

Next-Vision develops stabilized drone imaging solutions and experiences increased product demand.

Recently, the company launched new cooled cameras, increasing the observation range by almost five times compared to non-cooled cameras.

The cooled cameras allow better image resolution and higher sensitivity to temperature differences, providing enhanced detail on targets.

According to the company, the new camera is a "game changer" in the cooled camera market, offering attractive specifications and pricing for small drones and UAVs.

The potential of the cooled cameras is high, but we haven't seen this potential reflected in the current backlog or past sales.

Once Next-Vision's customers start adopting and developing their drones around Next-Vision's cooled solution, we might see a return.

The cooled system is critical to the growth because its pricing is much higher than the current pricing level of the solutions in the catalog.

Although the cooled cameras are new to the catalog, Next-Vision's strong reputation and ability to test the system with its current customer base give it a significant advantage.

$NXSN.TA Next Vision - Cooled Cameras

— EpsilonTal (@epsilontal) June 10, 2024

Next-Vision develops stabilized drone imaging solutions, and experiences increased product demand.

Recently, the company launched new cooled cameras, increasing the observation range by almost five times compared to non-cooled cameras.

The… https://t.co/0GIJbaMj2D pic.twitter.com/PGUYBeU9zh